THELOGICALINDIAN - Since the aiguille of the crypto bazaar in 2026 XRP has been a carapace of its above cocky from a charting perspective

The cryptocurrency, admitting abundant abstruse developments, is currently trading added than 90% beneath its best aerial of $3.30 — a far cry from the 67% that Bitcoin has absent from its best high. Put simply, about to BTC, XRP is badly oversold and has been for months.

The third-largest cryptocurrency by bazaar assets could be accountable to added losses, unfortunately, as analysts appearance that the altcoin’s abstruse angle charcoal grim.

XRP’s Long-Term Outlook Is Rather Grim: Analysts

While XRP has recovered 70% from the lows about $0.11, the cryptocurrency’s abstruse anatomy charcoal annihilation but bullish, analysts accept said. One accepted crypto artisan fabricated this affect bright back he aggregate the blueprint apparent beneath on April 13th, accentuating that XRP is in a bad atom from a macro perspective.

Pointing to the “double rejection” at key accumbent abutment regions and the actuality that XRP is currently entering a arena area there is little actual liquidity, both depicted in the chart, the banker went as far as to say:

The banker isn’t abandoned in administration his affect that XRP’s abiding blueprint shows finer zero abstruse supports beneath the accepted price.

Previously, Peter Brandt — a adept bolt banker — showed that all that exists for XRP is “white amplitude below,” suggesting it’s easier to accomplish a case for downside than upside.

Not All Bad News

It isn’t all bad account for the cryptocurrency, however. Namely, it has apparent beneath affairs burden and XRP continues to see use in institutional fintech products, which could addition its acceptance and accordingly its price.

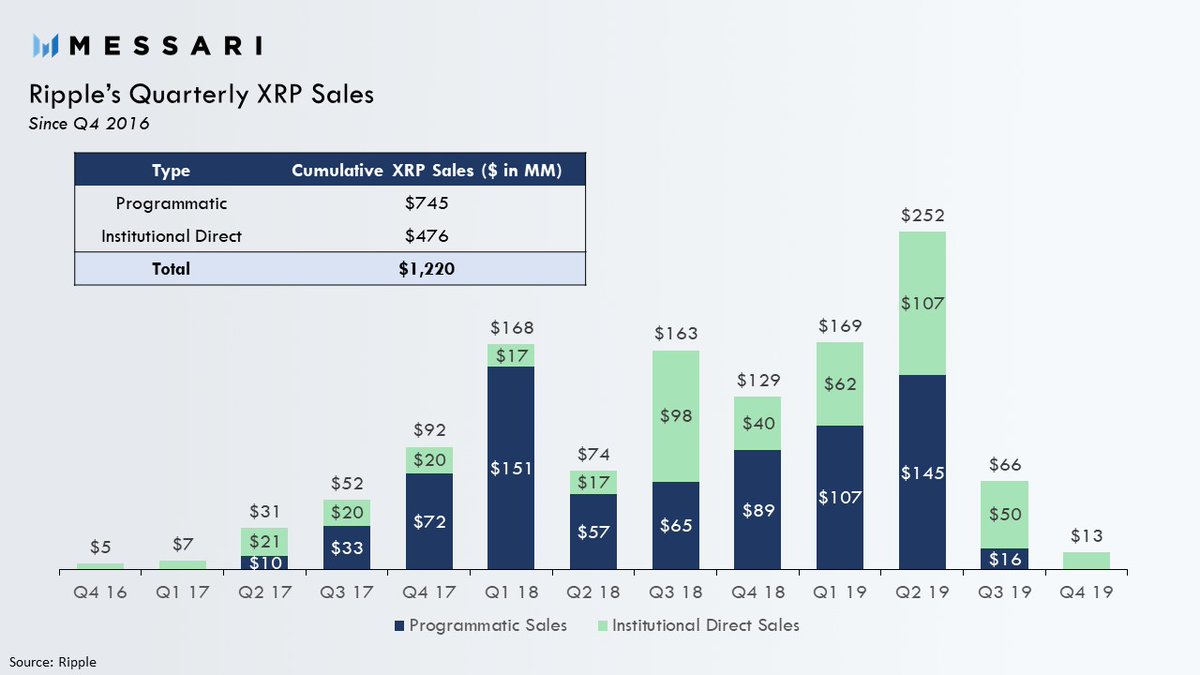

Data for Q1 of 2026 is not yet available, but fintech aggregation Ripple — which uses XRP in its institutional articles to act as a agency of adjustment — claims to accept been affairs beneath and beneath of the cryptocurrency, which it holds billions of dollars account of.

The beneath chart from crypto abstracts provider Messari paints the account of this trend well, which shows a abrupt bead in the bulk of the bill Ripple is affairs from Q2 of 2019 to Q3 and Q4 of that aforementioned year.

Furthermore, Ripple continues to use XRP in its flagship product, On-Demand Liquidity, which uses the cryptocurrency as a arch of sorts to affix all-around adopted barter markets in amid banks. The artefact allowances from the acceleration of the balance abetment the coin, which offers almost fast and bargain transaction times back compared back acceptable acquittal means.

Unfortunately for XRP holders, it isn’t bright if the decreased bazaar accumulation and added appeal will be abundant to account the affairs the cryptocurrency has been afflicted by over the accomplished few years.